When interacting with seasoned hotel executives about their online distribution mix, the talk invariably leads to dealing with sustained pressure exerted by OTAs. Other than commissions that hotels pay OTAs for bookings, hoteliers always strive to keep an eye on the visibility of OTAs on Google, too. And now meta-search has also become an indispensable battleground.

Hotels acknowledge the clout OTAs can have by tapping into leads emanating from a host of meta-search engines. For instance, as indicated by the L2 Prestige Hotels 2014 Metasearch Insight Report in July, OTAs control over 96% of booking listings on Kayak. But there are certain facets of the meta-search category that offer hotels special arrangements.

Today, users are being given options to reserve rooms and finish transactions with hotels without leaving the meta-search interface – even on the go. Choice Hotels International has been testing such functionality with TripAdvisor via the latter’s mobile app and mobile website.

Also, there are meta-searchers that follow a hybrid model, and directly compete with OTAs. For instance, China’s Qunar.com, which processed over 3 billion web and mobile search queries last year, not only offers CPC and display ad options, but it also charges on cost-per-sale basis (one pays for a click that results in a transaction).

All this means hotels have to scrutinize their expenditure even more closely. “As the number of traffic generation sites have increased the effort and costs have gone up,” said Chetan Patel, vice president of strategic marketing and e-commerce for Onyx Hospitality Group, Bangkok. “A lot more of these costs go into competing with OTAs. This is inefficient if many players are paying multiple times for the same conversions.” Patel adds that Google is “still the king” as far as traffic generation is concerned.

Patel has mixed views about the direct connect agreements being signed between hotel brands and meta-search sites. “The advantage is that there are some customers who would appreciate the efficiency if they already know what they want to book,” Patel said. “The very big negative is that we are in the commoditization trap again. We lose the opportunity to brand, differentiate and cross-sell.”

Patel shared that Onyx is in the process of tying up with Qunar and Trivago. The entity is already associated with Wego, Google Hotel Finder and TripAdvisor.

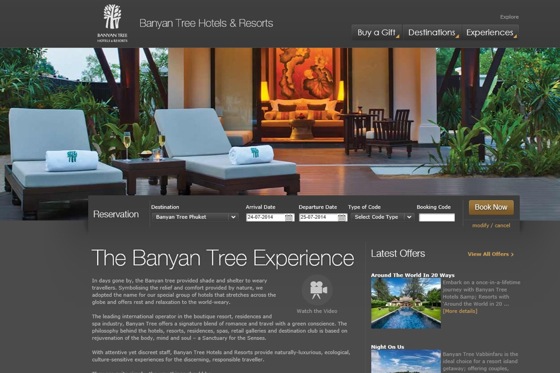

Singapore-based Devdutta Banerjee, director of revenue management and distribution for Banyan Tree Hotels and Resorts, Singapore, says one can expect a lot more action as hotels based in Asia Pacific strike deals with meta-search sites across the globe. He said hotel companies have realized the strength of technology and most hotel companies are now investing in technology to improve the consumer experience from the first point of search to post check out.

Banerjee agreed that meta-searchers facilitating hotel bookings for a specific brand via their interface would be attractive provided CPA costs prove to be lower than commissions paid to OTAs.

Strong scrutiny is must

As specialists point out, online direct booking is always high on the agenda of hotels. But they can’t ignore the collective prowess of OTAs for the way they leverage their presence on meta-search sites.

Even if a hotel brand website is doing a great job on several counts – say the average order value or the cost incurred on a booking – distribution executives can’t overlook how the dynamics are shaping up. OTAs are currently dominating listings on TripAdvisor and Kayak, and there is need for hotels to improve their use of Google Hotel Price Ads.

According to a source in the Asia Pacific region, the benchmark for incurring expenditure on marketing shouldn’t be more than 7% of the total revenue generated. And for the cost per acquisition per booking, it should be less than US$50.

According to another specialist, a hotel organization can monitor the room revenue garnered per booking as an efficient way of keeping a tab on marketing costs. So, if the look-to-book ratio is 1:20 on total room revenue of US$200, incurring marketing cost of US$20 per booking can be considered a fair benchmark.

Again, the major challenge arises when hoteliers are trying to target a larger base, and the cost of acquisition goes up specially since the initial returns are always lower but progressively improve.

Contributed by Ritesh Gupta