The new biannual BHN Hotel Investment Survey completed in January, coupled with input from industry experts, suggest European hotel investment activity will continue to grow despite the wobbly economic recovery.

Similar to past economic recoveries, Europe as a whole is trailing the recovery of the United States, while the United Kingdom seems to follow the United States more closely. As the U.K. hotel and real estate market has shown signs of a quicker recovery from the recession than the rest of Europe, money has been flowing into hotel deals in London. With acquisition prices high and on the rise in London and the market being crowded with investors, other locations in Europe finally appear to be poised to benefit from increased investment activity.

Economic trends

Compared to 2014, approximately half of the survey respondents believe Europe’s economy will be flat in 2015. Although slightly more survey respondents are positive then they are negative, the largest share believes that the year at hand will be similar to the current economic climate. This compares to optimistic results in the United States, where 81% of BHN survey respondents believe the economy will trend upward in 2015.

Echoing this outlook, past Hotel Investment Conference Europe (Hot.E) keynote speaker David Smith, economics editor, The Sunday Times in London shed some light on the outlook and reason for uncertainty. “The outlook for the euro-zone is clouded by renewed political uncertainty and very weak growth at the single currency’s ‘core,’ notably France and Italy,” Smith said. “But prospects in some of the peripheral economies have brightened, and the fall in oil prices will provide a boost for European consumers. In Britain there is some evidence that the pace of growth has softened, but the economy should still outperform all the other big European nations. The main risk is political — the danger of an inconclusive outcome in May’s general election, which could add to the uncertainty.”

When considering economic cycles as well as opportunity differences across Europe, Rod Taylor, managing director, Taylor Global Advisors Ltd. shared, “The U.S. is ahead of the U.K., which is itself 12 months or even more in front of mainland Europe. As such U.S. funds and individual investors may quite reasonably be thinking that their economic — and, thereby, investment — cycle will bottom out earlier in the U.S. than in the U.K. and Europe. Therefore, Europe might offer better opportunities to acquire but also successfully dispose of hotels bought within the usual investment horizon of five years.”

The cycle, opportunities

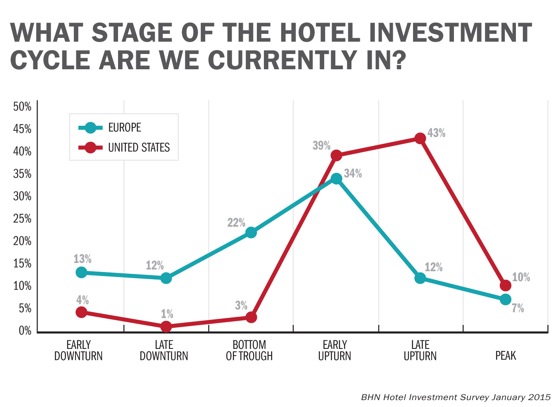

What stage of the hotel investment cycle are we currently in? Focusing on Europe, 56% of BHN survey respondents believe Europe is either at the bottom of the trough or in the early stage of an upturn. Taylor added, “I would agree with this, although I suggest the upturn is much stronger in the U.K., whereas in other European areas, even a late downturn might be applicable.”

When comparing the outlook for Europe to the U.S. survey results, 82% of respondents believe the United States is either in the early or late stage of an upturn.

In further elaborating on opportunities outside of London and the rest of the United Kingdom, Desmond Taljaard, managing director of hotels, London & Regional Properties, said, “The results of the survey are not a surprise, although in comparing the U.S. to Europe, I would say that the U.K. is much closer in the cycle to the U.S. than mainland Europe. The hotel investment environment in the U.K. has been very competitive for two years now, and therefore, while remaining very much fans of U.K. hotels, London & Regional more recently has been closing acquisitions in markets outside of the U.K., including Barbados, Austria and Spain.”

Better year for investment

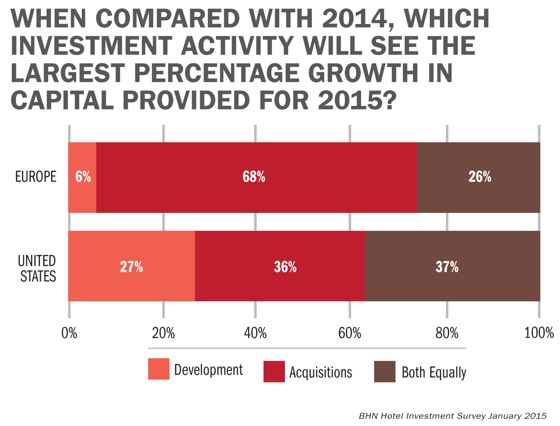

When compared to 2014 in Europe, 68% of survey respondents believe acquisitions will be the investment activity in 2015 seeing the largest percentage growth in capital provided. A minority share (6%) believe the investment activity with the largest growth of capital will be development. By way of comparison, the investment outlook in the United States is considerably more balanced, with 27% expecting development activity to grow the most and 36% expecting acquisitions to see the largest growth in capital.

What is the deal outlook for 2015? Charles Human, managing director, HVS Hodges Ward Elliott, commented, “We estimate that there is more equity capital chasing European hotel deals than at any time in the past, even at the peak of the last cycle. This, combined with the fact that there is more product for sale — much of it coming from profit-taking by those who bought early in the upswing — means that we expect 2015 volume to eclipse even the high levels recorded in 2014. The global PE funds still dominate the market, but increased Asian investment into Europe looks likely.”

Further emphasizing a strong 2015 for dealmakers, Josh Wyatt, partner, hospitality and leisure, Patron Capital, said, “Rising consumer confidence, a continued low-interest-rate environment and increasing liquidity within both debt and equity markets should make for a very strong 2015 for hotel dealmakers. Most hotel segments should perform and transact strongly, with a particular emphasis on budget and new/innovative products.”

Further elaborating on the capital markets as well as emphasizing the complexity of Europe, Theodor Kubak, external advisor, hotel investment and asset management, Union Investment Real Estate, said, “The present capital markets coupled with the strive of the brands to position themselves through predominately franchise vehicles are favorable for new players who have either the capacity to deploy their own funds or bring along the know-how to take advantage of the various support platforms provided by the brands to third-party operators to establish a presence in Europe. The main challenge will remain the scarcity of available products which requires an in depth understanding of the market and its opportunities. It is also true that this window of opportunity is now as, for the last few years, a couple of European players have successfully positioned themselves and there is a drive by new investors, brands and entities from the U.S. as well as from Asia which aim to penetrate the market.”