Transaction activity in Europe was picking up through the fall of 2021, and as long as business holds its own in 2022, expect M&A to sustain and grow.

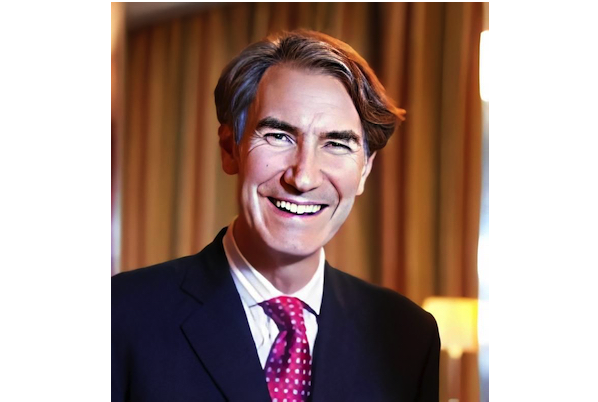

With improved trading comes increased investor confidence in their underwriting and thereby narrowing the bid-ask spread, said Charles Human of HVS Hodges Ward Elliott, London. “There is an unprecedented amount of equity looking to invest in the sector, and with valuations now on the rise again, some owners are seeing an opportunity to sell at a time when buyers are competing for few assets in the market,” he told HOTELS in November 2021.

Human, along with the London-based team at Avington Group, talked to HOTELS about their expectations for M&A activity in 2022.

What is the appetite for acquisition in your region?

Charles Human, HVS Hodges Ward Elliott: Appetite for acquisitions in Europe is probably as high as it has ever been, although much of the demand is hoping to find distressed pricing, which basically doesn’t exist and is unlikely to do so.

David Mongeau, J. Pedro Petiz, Avington Group: All regions we are present in (Americas, UK and continental Europe) continue to benefit from the most accommodative monetary policies of our lifetimes, a big factor in the recovery having been one of the fastest ever seen. Although these regions are at different parts of the upcycle, with North America leading, Europe six to nine months behind and South America another six months after, institutional and private capital (UHNI, Private Equity) are already looking for transactions across all regions as they understand the stages of the cycle each region is in, and anticipate continued improvement in operating activity as restrictions on movement, traveling ease and an unprecedented amount of pent-up demand from the leisure and group business unfolds.

Christian Bunte, Avington Group: Over the past few years, we have witnessed a resurgence in internationally acclaimed celebrity chefs and restaurant groups expanding to continental Europe and the UK, specifically within full-service and luxury segments. In London alone, we’ve had Daniel Humm at Claridge’s, Dani Garcia at The Mondrian, and Nancy Silverton at Treehouse, among others. This trend has increased pace as several existing restaurant operators have folded or vacated their leases as a result of COVID closures and business downturn. The new entrants believe now is the time in the cycle to enter critical global markets such as London. We are aware of several more planning to enter the London market from North America and Southeast Asia in the near term, both as part of new build hotels, as well as a key component of existing hotel refurbishments and reprogramming to position for rebound from COVID.

What type of deals are most likely to get done?

Charles Human, HVS Hodges Ward Elliott: Appetite is strong for large deals (portfolios and large single assets) from the private equity funds, so we do expect to see activity at the larger end. We have also seen a marked increase in appetite for resort hotels, which have fared well during the pandemic and we expect a continuation in this trend.

David Mongeau, J. Pedro Petiz, Avington Group: We believe that activity will remain strong across all asset classes, despite there being winners and losers as in previous recovery cycles. Large corporate and portfolio transactions will occur as the consolidation theme re-emerges and liquid corporate and institutional players view current market conditions as an opportunity to pursue general corporate themes or target competitors who don’t have the same financial flexibility. Similarly, there is significant private capital prepared to spend increasing amounts to build their own hospitality platforms and that are prepared to look at all type of deals, including smaller or individual assets, to achieve their objectives.

What are the ongoing barriers to deal making?

Charles Human, HVS Hodges Ward Elliott: First, a lack of hotels for sale. As values rise, this should change. Second, the lack of debt financing available. We expect this to change as trading continues to recover and travel patterns normalize.

David Mongeau, J. Pedro Petiz, Avington Group: The largest barriers to deal-making remain continued uncertainty surrounding new outbreaks of COVID-19, seller value expectations which are out of sync with the market and their assets’ capital generating capabilities, and a growing concern about inflationary and labor shortage pressures. All of these problems are likely to improve over the next 12 months, especially with central banks moving to stabilize interest monetary policy. However, we believe that an international coordinated regulatory framework for hospitality operations in a post-COVID world would have a significant positive impact for the industry globally.

What is the state of the financing climate (debt availability)?

Charles Human: Very limited. Few mainstream traditional senior lenders are issuing new loans. Alternative lenders are lending, but at opportunistic rates.

J. Pedro Petiz, Avington Group: Although central banking policy remains extremely accommodative, hospitality lenders remain cautious in their underwriting of transactions and are being selective in their approach to lending based on what segment their borrowers operate in. A full recovery of the meetings and events business remains several years out due to pandemic-related restrictions, a reduction of business travel budgets, and a general preference for corporations to act cautiously and protect their employees. Lenders understand this, and as such, have been more cautious in underwriting properties in those segments. In contrast, lifestyle and resort financing activity remained extremely strong throughout 2021 and continues to benefit from ample, and low cost, debt availability.

What is the potential impact of increasing interest rates?

J. Pedro Petiz, Avington Group: Over the last 18 months, we have seen one of the most accommodative interest rate environments in recent memory. As such, we do not believe that a move to stabilize monetary policy will be a drag on the recovery. Such policies will be the natural, and prudent, next steps for the recovery, and are likely to have a positive impact on some of the clouds over the industry’s outlook, including inflation, supply chain strains and labor shortages. We also believe that this next step of the recovery will ‘clear the skies’ and clearly show who the winners from this recovery cycle will be.