After investment in Spain tripled in 2021 to €3.18 billion (US$3.6 billion), the third-highest level of deal activity ever recorded in the market, 2022 is already proving to be just as strong, according to Colliers research, especially with a pipeline of deals in place with volumes approaching €1.5 billion (US$1.7 billion).

“Overall, we believe that the trend of the past year will continue and that, with a few exceptions, we will not see many distressed transactions,” said Colliers’ Laura Hernando. “As already observed, quality assets have weathered the storm best and will continue to do so. The market fundamentals are very positive, including the country’s global leadership in tourism, strong investor appetite, excess liquidity with interest rates at historic lows, high purchasing pressure and plenty of repositioning opportunities.”

Foreign investment vehicles have been the main players on the buy-side. As in recent years, the international origin of the acquiring funds was particularly noteworthy, reaching €1.8 billion (US$2.1 billion) in 2021, representing 58% of the total. Most of these players are core or value-added investment funds such as Brookfield, Archer Capital, Schroders, Castlelake or Lasalle Investments which are firmly take the Spanish market.

Top 10 investors

# Investor Hotels Rooms

1 Brookfield Asset Mgmt. 4 2,236

2 Archer Hotel Capital 1 200

3 Bankinter/GMA 8 1,660

4 Schroders 2 461

5 Castlelake 10 539

6 Lasalle Investment Management 1 255

7 RLH Properties 1 111

8 Blasson Property 1 137

9 All Iron RE 8 367

10 Starwood Capital 1 429

Deal volume in Spain last year included hotels in service, properties to be converted into hotels and land for hotel use, as per data provided by the Hotel Investment Report produced by Colliers.

Last year, a total of 127 hotels and 22,249 rooms were transacted in Spain, versus 68 hotels and 7,228 rooms in 2020. Furthermore, another 18 transactions took place for hotel development land and properties to be converted into hotels.

Only in two previous years (2017 and 2018), have there have been hotel investment figures in Spain exceeding €3 billion (US$3.4 billion), which highlights how extraordinary this figure is (26% higher than 2019).

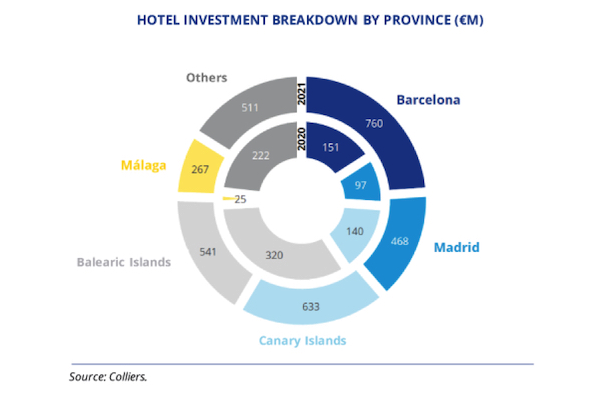

Barcelona and Madrid competed for the most deal in the urban segment, while the Canary Islands and the Balearic Islands were the 2021 holiday destinations for investors.

Barcelona and Madrid were once again the leading urban destinations with €760 million (US$867 million) and €468 million (US$534 million) respectively, accounting for almost 39% of the total for the second consecutive year. Significant transactions, such as the sale of the Hotel Sofía and Expo – as part of the sale of Grupo Selenta to Brookfield; the NH Collection Gran Calderón acquired by Lasalle Investment; and the Grand Hotel Central and the former Tryp Apolo, both acquired by Schroders; are just a few of the 23 transactions registered, which have led Barcelona to reach its highest annual record ever.

Meanwhile, Madrid, with 10 transactions, recorded the largest single asset transaction. Hotel Edition was acquired by Archer for over €200 million (US$228 million), which equates to the highest price paid per room. Hotel Bless was acquired by RLH for over €1 million (US$1.1 million) per room.

In the holiday segment, the Canary Islands and the Balearic Islands were the main destinations, totaling €633 million (US$723 million) and €541 million (US$618 million) respectively, representing 37% of total investment. Activity included both outstanding single asset transactions, such as the sale of the H10 Punta Negra to Blasson Property for its conversion to the ultra-luxury segment and portfolio transactions by RIU and Grupotel.

Beyond the top four destinations, Málaga is worth highlighting as after a year of inactivity, it witnessed 13 deals for a value of €267 million (US$305 million) in 2021, including the purchase by the JV between Stoneweg and Bain Capital of H10 Andalucía Plaza and the sale of Hoteles Natali and San Fermín, both acquired by JVs between international funds and operators (Zetland Capital and Fergus, and Navis Capital and THB, respectively).

Last year also saw a revival of portfolio transactions resulting in 12 portfolios transacted, comprising 56 hotels and 9,375 rooms for a total volume of €1.2 billion (US$1.4 billion).

These include Brookfield’s purchase of Selenta Group for €440 million (US$502 million); Riu’s acquisition of the minority position held by TUI in its joint venture; Meliá’s sale of a majority stake in its Victoria Hotels & Resorts company to Bankinter’s private banking investors; and Castlelake’s entry into the capital of Socimi Millenium Hotels to boost its growth. At the end of the year, a new portfolio transaction was closed by Perial, acquiring a package of five B&B hotels from Corum, and the purchase of another four in 2022 has been announced.

Top 5 portfolio transactions

# Hotel portfolio Hotels Rooms

1 Brookfield by Selenta Group 4 2,236

2 Riu acquires 49% of JV with TUI 8 1,489

3 Victoria Hotels – Meliá, Bankinter 8 1,660

4 Castlelake stake in Millenium 10 539

5 Globales acquires Ola Hoteles 3 536